The earnings calendar is a valuable tool that helps investors stay up to date with a company’s financial performance. It is a schedule of dates on which publicly traded companies release their quarterly or annual earnings reports. These reports are closely monitored by investors as they can significantly impact a company’s stock price. In this article, we will provide an overview of the earnings calendar, how it works, and how investors can use it effectively.

What is an Earnings Calendar?

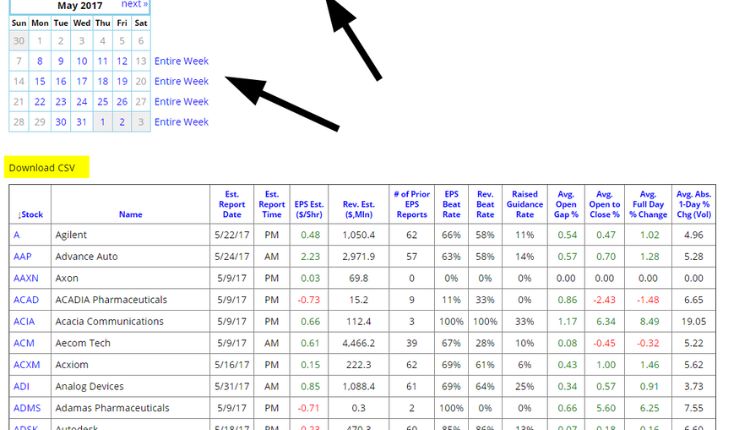

An earnings calendar is a schedule of dates on which publicly traded companies release their quarterly or annual earnings reports. These reports provide a detailed breakdown of a company’s financial performance, including revenue, earnings, and expenses. They are typically released four times a year, and the dates are predetermined by the company. The earnings calendar provides investors with an easy way to stay up to date on when companies are reporting their earnings.

How Does the Earnings Calendar Work?

The earnings calendar is an essential tool for investors as it allows them to track the financial performance of a company and make informed investment decisions. The calendar provides investors with the dates on which companies will release their earnings reports, which are usually made available before the market opens or after it closes. Investors can access the earnings calendar online or through a trading platform.

Investors can use the earnings calendar to plan their investment strategies, such as buying or selling stocks before or after the earnings report is released. If a company’s earnings report exceeds market expectations, its stock price may rise, and vice versa. Therefore, investors may decide to buy or sell stocks before the earnings report is released to take advantage of potential price fluctuations.

The earnings calendar can also be used to compare a company’s financial performance with its competitors. For example, if two companies in the same industry release their earnings reports on the same day, investors can compare their financial performance and make informed investment decisions.

How to Use the Earnings Calendar Effectively

To use the earnings calendar effectively, investors must stay up to date with the latest financial news and market trends. They must also have a good understanding of the company they are investing in and its industry. Here are some tips for using the earnings calendar effectively:

- Keep track of important dates: Investors must keep track of the dates on which companies release their earnings reports and add them to their calendar. They must also pay attention to any changes in the schedule, such as delays or early releases.

- Analyze the earnings reports: Investors must carefully analyze the earnings reports to understand a company’s financial performance. They must pay attention to key metrics such as revenue, earnings per share, and net income. They should also compare the company’s financial performance with its competitors and industry benchmarks.

- Plan investment strategies: Investors must plan their investment strategies based on the earnings reports. If a company’s earnings report is positive, investors may decide to buy its stocks, and if it is negative, they may sell its stocks. However, investors must also consider other factors such as market trends, economic indicators, and company news.

Conclusion

The earnings calendar is a valuable tool for investors as it provides a schedule of dates on which companies release their earnings reports. It allows investors to stay up to date with a company’s financial performance and make informed investment decisions. By analyzing the earnings reports and comparing a company’s financial performance with its competitors, investors can identify investment opportunities and plan their investment strategies effectively. However, investors must also consider other factors such as market trends and economic indicators before making investment decisions.

FAQs:

Why is the earnings calendar important for investors? The earnings calendar is important for investors as it provides a schedule of dates on which companies release their earnings reports